2017/07/20 Commentary: ‘Normalization Bias’ NOT Back Redux

© 2017 ROHR International, Inc. All International rights reserved.

Extended Trend Assessments reserved for Gold and Platinum Subscribers

Commentary: Thursday, July 20, 2017

‘Normalization Bias’ NOT Back Redux

There’s a question we would like to pose that relates to the observations out of last Wednesday evening’s post-Yellen testimony Commentary: ‘Normalization Bias’ NOT Back!! post that the central banks are not as hawkish as some folks had inferred from their previous comments. This was obvious in Fed Chair Yellen feeling federal funds rate increases might be close to the end. This was a surprise to some who had felt the ‘normalization’ talk of the previous several weeks from key central banks signaled the dawn of a less accommodative central bank era. That actually went back to several weeks ago Tuesday when BoE head Carney shifted to a more hawkish anti-inflation stance, and especially ECB President Draghi speaking effusively about how much he liked the real improvement in the Euro-zone economy. The latter was interpreted as a hawkish sign.

There’s a question we would like to pose that relates to the observations out of last Wednesday evening’s post-Yellen testimony Commentary: ‘Normalization Bias’ NOT Back!! post that the central banks are not as hawkish as some folks had inferred from their previous comments. This was obvious in Fed Chair Yellen feeling federal funds rate increases might be close to the end. This was a surprise to some who had felt the ‘normalization’ talk of the previous several weeks from key central banks signaled the dawn of a less accommodative central bank era. That actually went back to several weeks ago Tuesday when BoE head Carney shifted to a more hawkish anti-inflation stance, and especially ECB President Draghi speaking effusively about how much he liked the real improvement in the Euro-zone economy. The latter was interpreted as a hawkish sign.

All of that came in the wake of a US FOMC meeting and press conference where the economic and future federal funds rate projections were very strong. As recently as that mid-June meeting the Fed was projecting another rate hike in 2017 and three more in 2018 only a month before Janet Yellen indicated they might mostly be finished!! Yet that fit right in with a return to serial weak US data, which made the Fed perspective reversal less of a surprise than a relief for us. And that was reinforced this morning by Signore Draghi.

The inferred less accommodative ECB position was in the wake of his Tuesday, June 27th speech at the ECB Forum in Sinha, Portugal where he pointed up the sustained Euro-zone economy improvement. And after a still very accommodative opening statement at this morning’s post-rate decision ECB press conference, many of the press referred to this as Draghi’s ‘Sinha’ speech. They kept trying to draw him on misplaced inferences that the speech signaled a shift in ECB policy. Yet a very happy and relaxed Draghi (Merry Mario) dismissed all such implications, and reconfirmed the plan to continue full ECB stimulus until the end of 2017 or beyond if necessary. Don’t take our word for it… click out to the full ECB transcript and link to the video.

That gets us to the question: When central bankers get caught up in temporary bouts of ‘normalization bias’, are they just ill, or are they ‘carriers’? That relates to a financial press that thrives on reporting change, and sometimes likes to imagine it where none is actually occurring. In a conversation with Yra Harris of Notes From Underground blog we decided they are just trying to gain readership…

Authorized Silver and Sterling Subscribers click ‘Read more…’ (below) to access the balance of the opening discussion. Non-subscribers click the top menu Subscription Echelons & Fees tab to review your options. Authorized Gold and Platinum Subscribers click ‘Read more…’ (below) to also access the Extended Trend Assessment as well.

NOTE: Given the likelihood the US economy will now get the structural reform that we (along with Mario Draghi and others) have been loudly complaining was not forthcoming since our dual It’s Lack of Reform, Stupid posts in January 2015, we need to adjust our view that a potential economic and equity market failure is coming. We previously referred you back to our December 8, 2015 post for our major Extended Perspective Commentary. That reviewed a broad array of factors to consider Will 2016 be 2007 Redux? While a continued regime of higher taxes and more regulation (i.e. under Clinton) might have fomented a continued weak or even weaker US economy, the tax and regulation changes proposed by the Trump administration will hopefully still be approved by the Republican Congress and diminish the similar fears we had to what transpired in 2007-2008.

▪ …which is how they justify their existence in spite of their lack of understanding of the ‘real’ central bank psychology at many junctures. Yra and I had to consider that they are possibly just not that smart (not likely), or had ulterior motives in attempting to foment interest in what is a fairly uninteresting, unchanged situation (more likely.) For more on just how dovish the ECB has been, see Yra’s Comments in a CNBC Santelli Exchange discussion in last Wednesday’s Commentary: ‘Normalization Bias’ NOT Back!! post.

At this morning’s press conference they repeatedly referred to Draghi’s ‘Sinha’ speech, and the inferences that were drawn on the alleged less accommodative ECB position. They noted the ECB might have ‘misled’ the markets, and risked a ‘taper tantrum’ on the order of the mid-2013 US bond market slide after the Fed’s QE taper announcement. While the Bund was weaker than US and UK govvies into the lows two weeks ago, it was nothing like the 2013 US govvies slide. And it has recovered to similarly higher levels since the obvious reinforcement of the ECB’s still accommodative position. (Also note the major US bond selloff into early 2014 was reversed across time on weak US economic data.)

And ‘Merry Mario’ blithely dismissed all of the press’ leading questions on variously…

“Will a changed be announced in September?” “Will ECB terminate the Asset Purchase Program (its QE) prior to the end of 2017 if the economy continues to strengthen?” “What specific information is the ECB looking for that might cause accommodation to be curtailed sooner than projected?” (Answer: “Nothing that specific versus general.”)

Draghi was steadfast in asserting that nothing would change until the ‘fall’, due to the next set of ECB staff economic and inflation projections not even being available until into the September meeting; at which point they will first be properly assessed for whether there is indeed any reason to become less or more accommodative. This led to the ridiculous (hawkish inferences from the actually still accommodative Sinha speech) classically giving way to the sublime…

Press Last Grasp

In a late press conference (at 46:30) grasping at straws by a reporter hoping to still draw the ECB President on some change being possible (in spite of all of the indications in the opening statement and previous press conference answers), he asked, “My second question is, does 7 September count as the fall, the autumn?”

After a visceral giggle (see the opening graphic) at this obvious ‘reach’ for anything controversial, Signore Draghi responded, “Well, if the Governing Council had decided to define autumn as 7 September, we probably would have said that 7 September is going to be when we’ll decide. So it’s going to be deliberately kept open.”

Steady as She Goes

And there you have it. Steady as she goes on likely continued accommodation from the ECB at the very least until the October meeting, and likely beyond. That is in spite of the clear indications that the Euro-zone economy continues to improve, which (as noted in last Wednesday’s Commentary: ‘Normalization Bias’ NOT Back!! post) is in part a sop to the Germans. That is on the likelihood that very accommodative ECB monetary policies are more likely to be scaled back than expanded; even if not any time soon.

That is all consistent with the degree to which Mario Draghi and most of the ECB Governing Council agree that Euro-zone economic improvement is based in part on the previous, and future continuation of, accommodative ECB monetary policy and stimulus. As such, they feel constrained to continue their QE program to at least its current end of 2017 projected termination, and possibly beyond.

Classical Models Not Performing

The other key indication in the press conference Q&A, preceded by references in the opening statement, was the observation that classic employment-inflation models were not performing as they had prior to the 2008-2009 Crisis. This should not be a surprise to any well-informed observers, as we had been asserting this since early 2015 (that January’s dual Commentary: It’s Lack of Reform, Stupid! posts.) That was based on our own analysis to some degree, yet also substantially reinforced by assessments from quite a few other well-regarded analysts.

As also already extensively explored in last Wednesday’s ‘Normalization Bias’ NOT Back!! post, that is due to the lower caliber of jobs being created during the US and European employment recoveries to above the pre-Crisis totals. For much more on this see last Wednesday’s post and previous posts under the search terms ‘normalization’ and also especially ‘normalcy’ in earlier posts.

There will be more on the breakdown of the classical models below. That return (redux) on the central banks shedding their ‘normalization bias’ allows for more adherents every day to the idea that the classical models are broken. And that is from many folks who had previously accepted the old ‘Phillips curve’ model (employment strength brings inflation) central bank models; even including central bankers themselves.

Yet first we are going to review some of the key market tendencies.

EQUITIES

It was obvious US equities had seen the September S&P 500 future stall against higher 2,450 area congestion during June. Weakness at the end of the month saw it violate the 2,430-25 interim support that it then churned above and below prior to a couple of selloffs to more major support. That was not a surprise after attempts prior to last week failing to push back above 2,430-25.

Yet as noted for some time now, the more important support was the old March and May 2,405-00 all-time highs. That area held very well prior to a strong bounce three weeks ago, and was only barely neared on the selloff two weeks ago Thursday (trading low 2,405.50) prior to that Friday’s gap higher on the positive US Nonfarm Payrolls number.

And after the post-Yellen push to a new high last week, the hefty 2,450-46 congestion held as support on Tuesday. That fostered a recovery by the Close. The next weekly Oscillator resistance moved up to 2,475-80 this week, which has been tested prior to the current slippage. That moves up to 2,485-90 next week on the still aggressive upward trajectory of weekly MA-41. The ultimate weekly Oscillator resistance (last seen in early March) is up to 2,515-20 next week.

GOVVIES

The govvies are also very interesting once again, as the September T-note future and Gilt both held their respective 125-00 and 125.00 weekly channel supports on the selloff into the lows into early July. It will now be interesting to see whether they can also push back above their relative low-mid 126-00/126.00 congestion or need to sink back to lower levels. If they succeed in violating those resistances their respective higher levels are T-note 128-00/-16 and Gilt 127.50-128.00.

The exception to the stubborn holding action of the others was the September Bund future that broke the equivalent 161.50 channel support (to the others’ 125 areas.) Yet it held very well down into the upper end of more major lower 160.50-.00 congestion at the lows into early July. That is only reasonable given the stronger German and Euro-zone economic data at present. Yet it is on the mend as well on the friendlier Yellen views last week and especially the Draghi confirmation of ECB accommodation this morning. It also has key contract and continuation resistance up into the 162.00-.50 area that includes all the weekly moving averages (i.e. MA-9, MA-13 & MA-41.) Only above that can it challenge the 164.00-.50 hefty congestion last seen prior to Draghi’s late June Sinha speech.

FOREIGN EXCHANGE

It is also still interesting in foreign exchange that the secular strength in the euro has maintained with less strength in other currencies against the US dollar even as the Japanese yen and Australian dollar have indeed strengthened. And with the return of more accommodative US central bank psychology along with signs of economic health elsewhere (Europe and China) the emerging currencies seem to be reinstating their first half of 2017 up trends after temporary corrections. The strength of the Mexican peso and South African rand are especially interesting for further follow-through potential.

EUR/USD maintaining its trend above the hefty 1.1400-1.1500 area historic congestion and extending its rally to above the first of the key Tolerances above it in spite of Draghi’s accommodative stance is striking. That 1.1616 May 2016 spike high temporarily out of the 1.14-1.15 range being exceeded leaves only the 1.1710 August 2017 also temporary spike high above the range as the last resistance this side of the 1.2000 area.

Even though GBP/USD managed to not slip too far from the top end of the 1.28-1.30 range. However, AUD/USD is now back up nearer its .7750-.7800 resistance, and even the recently beleaguered yen has seen USD/JPY back off from its most recent push above 1.1400 area. All-in-all a weakening of the greenback on the more accommodative Fed communication of the past two days.

EMERGING CURRENCIES

The emerging currencies bounce from their recent selloff which for the most part only started with the ‘friendly Fed’ influence this morning had actually violated some key supports. Those are now the same levels they will need to trade back through to reestablish more upside momentum against the US dollar. Those levels include USD/MXN that held up much better than some others over last week already back below 18.15 continuing to weaken below the 17.90 August 2016 13-month trading low. If it continues, then the next significant support is not until the 17.00 area.

And the Turkish lira that saw USD/TRY basing into the key 3.55-.45 range since early June is back to the top of the range after squeezing above it to 3.64 interim resistance last week. Whether it can break below that lower support (including all the weekly moving averages) is very important, due to the next minor interim support not until 3.40 yet with major 2015-2016 congestion support not until the 3.10-.00 range.

USD/ZAR that once again ranged above both the 13.15-.20 and 13.30 areas into 13.50 area resistance (including weekly MA-41) must continue back below those lower levels to continue its slide, with both of the two recent selloffs getting to the more major 12.50 major congestion. Even the recently politically beleaguered Brazilian real that saw USD/BRL spike up to 3.40 in mid-May is now back down into the key 3.20 area. Much below that a swing back down to (or near) February’s 3.04 2-year low is likely.

And last but not least, some sort of recent political or economic pressure must be plaguing the Russian ruble that has not benefitted from Crude Oil’s recent recovery. While USD/RUB has not pushed up through the 61.00 Tolerance of the 60.00 resistance, it has not fallen very far from it either even as other emerging currencies exhibit more strength against the US dollar. That is important not only because 60.00 is hefty recent and historic congestion, weekly MA-41 is also at 59.60. That must be violated once again to establish more momentum down toward the lower 56.00 recent hefty congestion.

That is it for now on the near-term trend indications, and we encourage anyone who is interested to reference the Market Observations (lower section, available to all Gold and Platinum subscribers) in last Wednesday morning’s “Commentary: Bond Bubble Burst?” post that were fully updated Thursday morning.

Abandoning the Phillips Curve

For all the many reasons discussed previous on the breakdown between higher inflation being driven by stronger employment, many more previous adherents to the central banks hypothesis that inflation needs to be anticipated and proactively fought are abandoning that view. That includes the analysts, the press and the central banks.

Prior to discussing the range of respected folks who are joining the ‘broken model’ band wagon, it is important to return to a reliable, unbiased source for some further insight on the extended employment weakness in the US. That is likely as much a reason for the lack of US inflation as any ECB liquidity-driven low interest rates. That is once again the Organization for Economic Cooperation and Development (OECD), which we tend to pay more attention to than quite few other analysts due to the accuracy of its extended views on the global economy and individual country performance.

There was so much else happening Monday morning (GOP abandoning US healthcare reform, important Chinese and Euro-zone figures) that it was easy to miss the OECD’s latest Quarterly Employment Situation. While that was a typically delayed OECD release (to ensure stabilized data) going back to Q1, it is still instructive.

Two items are especially noteworthy. The first is the page 1 left hand graph that shows Euro area employment finally exceeding the total percentage of the ‘working age population’ employed back in Q1 2008. What are especially striking about that is the other countries outperforming the Euro area, except for one: the US!? For all of the trumpeting of new high employment levels in the US from the various politicians, the percentage of the working age population employed is actually quite a bit lower than Q1 2008.

This is of course in part due to US population growth that leaves it with a larger potential workforce. Yet it still points up the weakness in an employment situation where the central bank is misguided in inferring the sort of ‘normalization’ (i.e. stronger growth) that anticipates a return to levels of inflation that require aggressive tightening.

Recent Employment Demographics

The other immediately striking aspect of the OECD’s Quarterly Employment Situation is the lack of annualized hiring in a key demographic group. The graph on the right side of page 1 highlights similar annualized (Q1 2016 - Q1 2017) hiring in the Youth (15-24 years old) group with real weakness in ‘Older workers’ (55-64.) Yet as opposed to the view that the weakness of the US Labor Force Participation Rate is due to Baby Boomers retiring, these are the folks who are normally in their prime late career earning phase.

Their lack of employment (and thereby earning power) explains at least some of the recent weak US Retail Sales and other consumer numbers. And there is also the still weak overall OECD-wide Q1 2016 - Q1 2017 employment gains for prime-age workers, at just 0.5%. This is more likely the cause of continued employment weakness than Baby Boomers retiring.

And we have recently shared other telling analysis on this very point we revisit here…

The US Employment ‘Myth’

This is of course very consistent with the article we cited in last Wednesday’s ‘Normalization Bias’ NOT Back!! post from The Bear Traps Report by Larry McDonald on The Demographics Myth Inside Labor Force “Participation”. In its way that analysis goes much farther into the extended background on the lack of high-paying jobs due to lack of employee productivity. And more important is its longer-term look at the lack of overall prime age (25-54 year-olds) workers in employment. This belies the ‘myth’ that the lower US Labor Force Participation Rate is a long term demographic adjustment reflecting Baby Boomer retirement, and we still recommend a read of McDonald’s very concise, well-documented and illustrated analysis.

Ex-BoE Member Blanchflower Slams Fed

While he is currently a tenured economics professor at Dartmouth College in New Hampshire, David Blanchflower earned a degree of notoriety as an external member of the Bank of England's interest rate-setting Monetary Policy Committee (MPC) from June 2006 to June 2009. While some questioned his out-of-the-box assessments, it is interesting that in 2009 he was appointed Commander of the Order of the British Empire (CBE.) While that was for more than his BoE service, it is a sign of the respect his views had garnered.

In a recent Business Insider article he is cited on many reasons for believing employment is not as strong as headline unemployment figures indicate. Specifically regarding the Fed he asks, “"Why are you raising rates? Inflation is weak because we're in a cyclical down point - there's much more slack than the unemployment rate suggests…" He is also cited as referencing policy makers continued misguided faith in the ‘Phillips curve’, noting, “This is a huge intellectual failure.”

As we and many other observers have noted from time to time the article notes his observation, “The same inflation hawks within and outside the central bank have been warning about imminent inflation for years, Blanchflower said, only to be proved wrong time and again: ‘It's really here, it's really coming, it's really coming, inflation is right around the corner.’ Indeed, it never has.”

And the article concludes with a graph of one of the Fed’s favored inflation gauges, the Personal Consumption Expenditure Price Index. That shows what we have already seen in the less-then-strong US inflation numbers: a brief push above the Fed’s 2.0% target earlier this year prior to falling all the way back to 1.4%.

Banks Rue to Admit Failure

And the philosophy that made Blanchflower one of the more respected Bank participants (if sometimes disdained by more conservative BoE members) is his creative interpretation of what the economic data and economic psychology are saying. While at the MPC he delivered the Keynes College speech “Where Next For The UK Economy” on October 29, 2008 on the failings of the prevailing central bank approach to economic analysis that had seen all of them ambushed by the 2007-2008 economic weakness.

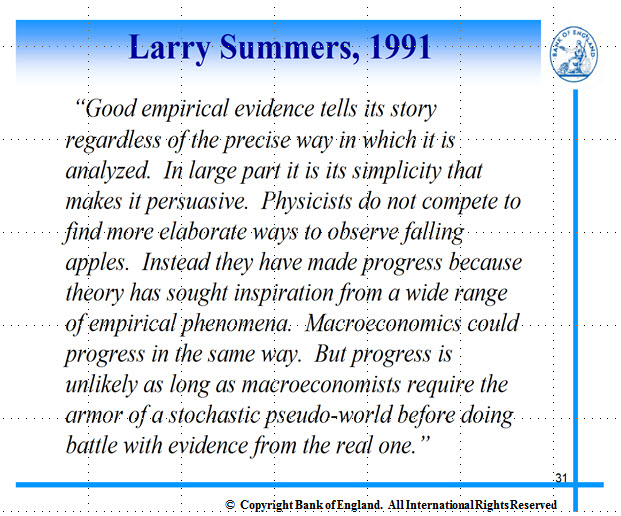

We utilized part of that in our November 2008 Capital Markets Observer review of the Super-Cycle Correction with a Super-Cycle Correction slide show that covered quite a bit of long-term historic reference for the 2008 US Housing and Credit Bubble bust. We included a few slides from Professor Blanchflower’s October 2008 “Where Next For The UK Economy” presentation. Among the most telling on overall background to serial major failures of the economic analysis field was a quote he used from a much earlier assessment by Lawrence Summers. In essence Summers was scathing in his criticism of the economic profession (and especially the central bankers) for not spotting major shifts. And that was in 1991.

For anyone interested in Summers’ full (rather lengthy) research presentation, it was his The Scientific Illusion in Empirical Macroeconomics (The Scandinavian Journal of Economics, Vol. 93, No. 2, Proceedings of a Conference on New Approaches to Empirical Macroeconomics. Jun., 1991, pp. 129-148.) It was seriously criticized by many mainstream economists both at the time and since. Maybe that much more reason to give it a read in light of the abysmal performance of so many economic analyses since that time right into the Fed’s forecasts across the current cycle.

For anyone interested in Summers’ full (rather lengthy) research presentation, it was his The Scientific Illusion in Empirical Macroeconomics (The Scandinavian Journal of Economics, Vol. 93, No. 2, Proceedings of a Conference on New Approaches to Empirical Macroeconomics. Jun., 1991, pp. 129-148.) It was seriously criticized by many mainstream economists both at the time and since. Maybe that much more reason to give it a read in light of the abysmal performance of so many economic analyses since that time right into the Fed’s forecasts across the current cycle.

And tangentially it is interesting that The Scandinavian Journal of Economics was the academic financial journal where he had to publish it! It seems something as radical as this assessment of the craft should possibly have been published in somewhat of a more prominent economics journal. We cannot know this for certain, yet it seems possible that none of the more prominent academic resources wanted to publish something so critical of the economic analysis profession’s lack of effective major economic shift analysis.

If so, shame on them, as Summers’ assessment has proven prescient again and again across the major longer-term cycles. Yet for the most part the economics profession seems content to stick with only those projections and predictions which conform to gradually evolving trends (his reference to its “…stochastic pseudo-world…”) instead of being sensitive to the potential for radical shifts.

Is Quantitative Easing Really a ‘Success’?

All of which gets back to the psychological reason the central bankers are still so married to the Phillips curve. If all of their pushing the size of balance sheets is not working to invigorate the broader economy in the manner they promised, then it is just a major distortion that favors the investor class. That is on the liquidity flowing into equities because other ‘risk-free’ financial assets (notably govvies) cannot provide any return during the attendant very low interest rate phase encouraged by central banks.

It was a financial boon rather than an overall economic boost. It may also be as much a good idea in limited quantities that was taken too far after its initial success. In that regard the Federal Reserve’s initial QE in early 2009 was indeed enlightened as a means to stanch a full blown financial meltdown on major bank failures. The question is whether it went too far on the July 2012 start to QE-III (also known as QE-Infinity) third phase when Chair Bernanke was instructed by Senator Schumer to massively expand it.

Just prior to that Senator Robert Corker had noted the Fed had already gone very far in expanding liquidity, and it should be up to Congress to enact reforms that would take over stimulating the US economy. Yet as the minority Democrats were not inclined to cut spending, Schumer’s “Get to work Mr. Chairman” was his indication that the Democrats in the Senate were not going to cooperate as all with more budget conscious Republicans, and therefore the Fed was the only party that could prevent a slide back into recession. A very good discussion of the issues around that is available at http://fxn.ws/TPRa59.

Yet for all of the massive QE, the overall lack of investment incentives for business and headwinds from Obamacare requirements left the US economy still wanting for the sort of ‘well paid’ job expansion that could reinvigorate stronger growth. This is why Barack Obama is the only post-WWII President to not see 3.0% GDP growth during his tenure.

More US Inflation Weakness to Follow?

While the Financial Times is more often than not on the side of central bankers in their key mandate of inflation control, it has lately been questioning the need for more aggressive inflation fighting in what remains a softer-than-expected environment. This has been apparent in both its editorial stances as well as third party contributions. One of the most telling among the latter was Monday’s US inflation decline is too persistent to ignore blog post by Gavyn Davies.

Davies is a formidable economic analyst, and like David Blanchflower is known for looking at creative methods to arrive at more realistic economic projections than many standard models provide. He is the Chairman of Fulcrum Asset Management. He was the head of the global economics department at Goldman Sachs from 1987-2001, and was chairman of the BBC from 2001-2004. He has also served as an economic policy adviser in No 10 Downing Street, an external adviser to the British Treasury, and as a visiting professor at the London School of Economics.

As such, this week’s post from him on the real situation with US inflation should be respected for its use of the Stock and Watson method that seems to reject assumptions from the Phillips curve analysis. In fact, according to Davies’ blog post the Stock and Watson approach “…has now identified a clear downwards break in the underlying rate of headline CPI inflation in the US.” Furthermore, the analysis notes that this is not just for the headline figures, yet also for the more important ‘core’ readings.

Any even cursory review of the multiple graphs that accompany his analysis reinforces the insight on the sharp fall of US inflation into the first half of 2017. The forward view in the diffusion chart for the path of annualized US CPI inflation out of mid-2017 through the end of 2018 shows, “…that the Fed is only 30 per cent likely to hit its target…”

It is therefore not that big a surprise to those looking at the real future path of US inflation and wage levels associated with the substandard jobs creation (in spite of the sheer number of jobs) that things are not as strong as headline unemployment may make things appear. Janet Yellen surprised some folks with her testimony that the FOMC may be close to the end of the rate hike cycle. Yet it is interesting that since her comments the anticipation of the next FOMC hike has moved from September being a ‘live’ meeting to no hike likely until at least December. It speaks volumes about the Fed’s real understanding.

▪ The Extended Trend Assessment with full Market Observations will be updated after Friday’s Close to fully assess how various markets perform from key technical areas. That includes US equities up against key resistance, as are the govvies. There is also upside leader euro out above a major EUR/USD congestion area with only nominal trading levels above prior to a possible surge to higher levels. There is also the continued strength of emerging currencies that are experiencing a modest correction against the still weak US dollar of late.

The post 2017/07/20 Commentary: ‘Normalization Bias’ NOT Back Redux appeared first on ROHR INTERNATIONAL'S BLOG ...EVOLVED CAPITAL MARKETS INSIGHTS.