2017/06/16 Commentary: FOMC: All Options Open

© 2017 ROHR International, Inc. All International rights reserved.

Extended Trend Assessments reserved for Gold and Platinum Subscribers

Commentary: Friday, June 16, 2017

FOMC: All Options Open

The FOMC was in fact a bit more hawkish Wednesday. That is in spite of the fact that Janet Yellen is right that federal funds at 1.00%-1.25% are nominally accommodative compared to Core US Consumer Price Index data that just dropped back from 1.9% to 1.7% Wednesday hours before the afternoon FOMC announcements. Yet it is also the case which Chair Yellen and all other central bankers have always made that the central bank cannot get drawn into reacting when there is any minor aberration in the near term statistical context. The other related aspect is Thursday morning’s Bank of England (BoE) rate decision and meeting minutes (also the reason we waited until today’s extended market responses to provide views on the FOMC action and other influences.)

The FOMC was in fact a bit more hawkish Wednesday. That is in spite of the fact that Janet Yellen is right that federal funds at 1.00%-1.25% are nominally accommodative compared to Core US Consumer Price Index data that just dropped back from 1.9% to 1.7% Wednesday hours before the afternoon FOMC announcements. Yet it is also the case which Chair Yellen and all other central bankers have always made that the central bank cannot get drawn into reacting when there is any minor aberration in the near term statistical context. The other related aspect is Thursday morning’s Bank of England (BoE) rate decision and meeting minutes (also the reason we waited until today’s extended market responses to provide views on the FOMC action and other influences.)

One only needs to review the first few pages of the BoE Monetary Policy Summary and minutes of the Monetary Policy Committee meeting for reconfirmation of the unique inflation pressures in the UK. While at the last full BoE Inflation Report press conference on May 11th Governor Carney indicated a preference to favor employment over inflation mitigation, today’s 5-3 vote to hold the Bank Rate steady at 0.25% was closer than many had expected in spite of recent higher-than-expected UK inflation. That is another indication of major central bank accommodation withdrawal even as the European Central Bank and Bank of Japan are expected to remain very accommodative.

Yet the Fed’s situation is much different in dealing with still stubbornly weak inflation (like the Euro-zone and Japan) in spite of ostensible (the operative term) improvement in the US and other countries employment picture. (More on that below.) As Chair Yellen once again emphasized in her press conference as well, the Fed remains confident that current sluggish growth is transitory. The FOMC Statement kind of summed it all up, with very little change from the previous indications. Those who are inclined can also review Janet Yellen’s full hour long press conference as well as the revised projections.

The other factor returning after positive influence of AG Sessions’ testimony is President Trump aggressively tweeting once again. Temporarily unsettling for equities at times.

Authorized Subscribers click ‘Read more…’ (below) to access balance of the discussion. Non-subscribers click the top menu Subscription Echelons & Fees tab to review options. As this is a ‘macro’ assessment, Market Observations remain the same as last Friday morning’s update (lower section) of last Wednesday’s Commentary: Self-Inflicted Wounds are Back post, and there is no Extended Trend Assessment in this post.

NOTE: Given the likelihood the US economy will now get the structural reform that we (along with Mario Draghi and others) have been loudly complaining was not forthcoming since our dual It’s Lack of Reform, Stupid posts in January 2015, we need to adjust our view that a potential economic and equity market failure is coming. We previously referred you back to our December 8, 2015 post for our major Extended Perspective Commentary. That reviewed a broad array of factors to consider Will 2016 be 2007 Redux? While a continued regime of higher taxes and more regulation (i.e. under Clinton) might have fomented a continued weak or even weaker US economy, the tax and regulation changes proposed by a Trump administration that will likely be approved by the heavily Republican Congress now diminish the similar fears we had to what transpired in 2007-2008.

▪ Along with recent weaker US economic data, President Trump’s potential missteps with either misguided tweets or statements remain a key short-term risk for equities. That may carry with it the potential for pressure to return to a US dollar which has been buoyant (even if still only an upside reaction) since Wednesday on the back of the more hawkish Fed feel. And of course any Trump disarray on top of the recent serial weak US data will also continue to be supportive of the recently more buoyant govvies.

All of that relates back to the degree to which any sustained ‘Trump trouble’ distractions may continue to be an impediment to implementation of the very important administration reform and stimulus agenda. The key is that any major extension of the equities rally, any significant return to a more bullish US dollar trend, and the potential for the long-awaited major govvies reversal into a bear trend are still contingent on Trump’s reform and stimulus agenda spurring further real US growth.

As we explored that at length in last Wednesday’s (June 7th) Commentary: Self-Inflicted Wounds are Back post, we direct you back to that for the extended view on how Trump’s distractions are still an impediment to the accelerated US growth his team keeps promising is just around the corner. In addition to the review of other ways in which Trump’s more aggressive communications are pernicious at times in Tuesday’s (June 13th) Commentary: The Sessions Session post, last week Wednesday’s post also included key indications from (and a link to) the Organization for Economic Cooperation and Development’s (OECD) Semi-annual Global Economic Outlook released that morning that is still showing only very modest current and future global growth gains.

This was reinforced by Monday morning’s latest OECD Composite Leading Indicators release. As we noted in Tuesday’s post, while the OECD analysts tend to take an upbeat view, the actual graphs and statistics show growth may actually be stalling in key countries. Those include the US, along with sustained weakness in China. And the point is that a global growth picture that was encouraged in an anticipatory manner by Trump’s election still needs US growth to accelerate. Only that will support the upbeat valuations of equities (and US dollar strength and a return of govvies weakness.)

Back to Fed Anticipation

Of course, recent serial weak US economic data, and the potential for the future reform and stimulus-based growth acceleration to fail, leaves a still nominally accommodative FOMC looking a bit more hawkish. It has that ‘good old’ 2015-2016 feel to it.

For those of you who do not recall that phase, the Fed was proverbially ‘way out over the tips of its skis’ on asserting that things were back to normal (what we termed the Fed’s ‘normalization bias’ at the time) after years of low rates and Quantitative Easing (QE.) However, the post-Crisis recovery had so many US government imposed impediments to a typical strong post-deep recession rebound that the economy was not responding well in spite of the Fed’s massive QE liquidity injection and sustained low base rates.

And while the business environment has improved markedly in the wake of the Trump administration executive order regulation rollback, the real acceleration will likely only occur once there is more substantial tax and healthcare reform, and infrastructure spending stimulus. In the meantime, even the Fed is allowing it will remain (as always) ‘data dependent’. Note the minutes and Janet Yellen’s cautionary word on the ability to slow or even reverse its balance sheet shrinkage if conditions should warrant (i.e. the US economy somehow slides back into a weaker state.)

The Critical Data Dilemma

Also getting back to the 2015-2016 context, the Fed continues to assert that the US Q1 growth weakness is transitory. Much the same as that previous phase, it is projecting growth returning to much more robust levels for the balance of 2017 into 2018, with commensurate base rate increases. Yet to project one more 25 basis point increase in 2017 and three more in 2018 is very aggressive in the context of current economic data returning to some real across-the-board weakness.

On recent form that includes weakness in the recent US Employment report (including the key Hourly Earnings component), CPI Wednesday morning along with very important Retail Sales (which negated the previous month’s gains), Thursday morning’s Industrial Production, and Housing Starts released this morning as the latest shoe to fall.

The reason these are so important at this time is that Fed expectation is that weak US Q1 growth is the typical seasonal occurrence seen over the past several years. That had seen a considerable recovery commence once again beginning with Q2. Yet the latest economic data being released this month are spilling over well into the second quarter. Much more weakness in addition to those critical indications noted above would seem to point to a return to an overall sluggish economy.

As such, the balance of the economic releases this month into the key late month data like Durable Goods Orders, Personal Income and Spending, Consumer Confidence and of course the last of the US Q1 GDP revisions will be more critical than usual. If they are stronger than the recent data, then the anticipation of at least moderate economic growth will be maintained. Yet any further weakness will encourage a more downbeat psychology for the economy and equities, even as the Fed allows all options are open.

If weakness prevails, the Fed will look that much more overly anticipatory into an economic environment which does not support its outlook. Once again, this has that 2015-2016 feel to it. The one thing which might rescue the Fed’s aggressive view is the degree to which the President manages to finally stay out of his own (and Congress’) way so that his reform and stimulus agenda can indeed get passed into law.

The amusing bit there is Federal Reserve head Yellen confirming in her press conference what the FOMC meeting minutes said about the Fed not having incorporated any anticipation of government policy changes in its assumptions of consumer or investment spending. It would therefore be fairly ironic if Trump agenda success rescues the Fed from what at present appear to be overly optimistic assumptions, wouldn’t it?

Over-Reliance on Employment Gains

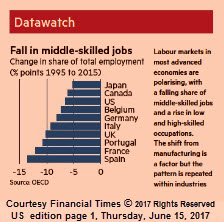

And revisiting a topic that we (among others) have pointed towards at many junctures since the 2008-2009 Crisis, employment since the Crisis is not the same as pre-Crisis employment tendencies. Thanks to the Financial Times once again for their timely provision of insights that seem to suit topics we are interested in exploring.

The graphic is very instructive on why the post-Crisis job gains are generating neither the inflation nor consumer spending levels that even lower pre-Crisis levels of employment had fostered. The ostensible improvement that saw the US lead those gains has now also seen other countries catch up to some degree. Just this week we got the news that the Euro-zone finally saw employment levels surpass the pre-Crisis levels.

That’s all fine and good. Yet the real story is the hollowing out of the well-paid jobs in middle-skilled employment. While there has been a rightful focus on offshoring of manufacturing jobs from higher cost centers (at first from the developed economies), much more of that is based on the automation of classic skilled labor tasks. And as the graphic notes, that tendency has also been within industries.

The latest predation of automation on human employment is the degree to which artificial intelligence (AI) is now impacting classic low-mid level white collar skills. Of late big firms in the legal profession have found rote research functions can be shifted away from junior lawyers. The AI programs which can research legal databases are not only less expensive (including no vacations, healthcare coverage or pensions), they have also been found to be much more reliable. Much like the previous revolution on the factory floor, the highly rhetorical question is, “Who is better at tedious repetitive tasks, humans or machines?”

This is why total employment in and of itself should no longer be such a key element that central banks count on as part of their economic and inflation models. They need to move to a more nuanced view, and we will allow that they already are very aware of the ‘downstream’ indications like consumer confidence and spending.

That said, the further AI progresses, possibly the more so central bankers should also be concerned that they can be replaced at some point. While that is likely quite a ways down the road, in the context of recent and projected AI advances maybe all options are open there as well. Hmmm.

▪ While there was no Extended Trend Assessment when this post was originally published, the overall changes since the June 9th Market Observations update of the previous Wednesday evening’s Commentary: Self-Inflicted Wounds are Back post have been significant enough to warrant advancing the Evolutionary Trend View this weekend.

The Market Observations have also been shortened to eliminate some of the extended background for each market which might be a bit dated. Any interest in extended analysis should be pursued through the Commentary: Self-Inflicted Wounds are Back post.

Thanks for your interest.

The post 2017/06/16 Commentary: FOMC: All Options Open appeared first on ROHR INTERNATIONAL'S BLOG ...EVOLVED CAPITAL MARKETS INSIGHTS.